Automate HMRC wage calculation with Papershift Time Tracking Software

Sign up for a free demo and save manual work with timesheet calculation.

Free HMRC calculator from Papershift

Papershift Payroll supports all industries of all sizes

Our customers include companies of all sizes and from a wide range of industries. They have one thing in common: Each of them has individual requirements, and we treat each of them accordingly.Our success is proven by our customer stories.

EDEKA

Supermarket branch with 50+ employees

"With Papershift we were able to reduce our workforce planning workload significantly.

The integrated payroll accounting is particularly helpful, as we can take different wage types into consideration. This has saved us 70% of the previous time required at the end of the month."

Raphael Dirnberger - Store Manager

BURGER KING

Centrally managing 1000+ staff over 50 locations

"Papershift helps us to make shift planning more efficient, helps keep the employees better informed, and makes the administration of all employees easier for us."

Alexander Feitsch, TQSR Holding and Development

Weyline Taxis

Scheduling 20+ staff across several offices and recording timesheets

"Papershift does exactly what you want it to do - the shift plan doesn't let you plan people who are away and it's also very easy to see which employee you're planning.

It just works really well."

Tracey, Administration Assistant

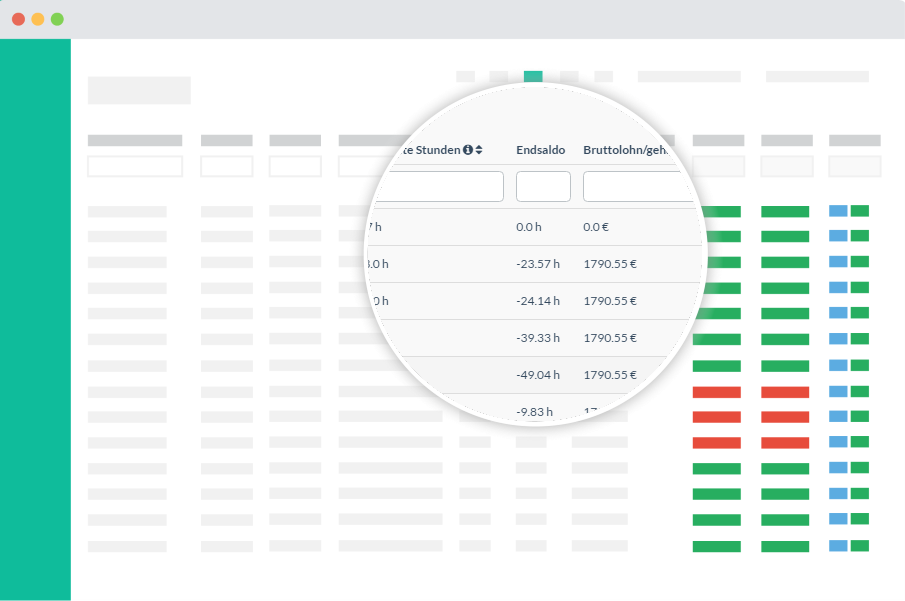

Overview of direct personnel costs to manage HMRC calculation

With Papershift’s Payroll addon, you always keep an eye on your employees’ gross pay, total payout amount per month, and employees’ hourly accounts.

Gross wages in focus

Gross wages and salaries, taking into account all types of wages, expenses, incentives, and surcharges.

An overview of hourly accounts

Based on the current hourly accounts of your employees, you can identify overtime build-up at an early stage and compensate for it by means of appropriate planning.

Payroll with integration

You always keep an eye on the total payout amount per month for your financial planning. Especially important for small and medium-sized enterprises to be able to estimate the costs for the current month.

Let's make payroll easy & fun to use

Check our guidelines and resources to help you automate payroll

Your frequently asked questions on HMRC tax calculator

What is Tax?

Tax is a compulsory contribution to state revenue, levied by the government on workers’ income and business profits. It can also be added to the cost of some goods, services, and transactions. The amount of tax you pay will depend on the item/service bought or the amount of money you earn in wages.

What Is a HMRC Tax Code?

A tax code is a series of numbers and letters, for example 1257L, S1257L, C1257L and K497. If you’re a full or part-time employee these codes are used by your employer to calculate the amount of tax they need to deduct from your wages before it’s paid into your bank account. If you have a pension, you will also be given a tax code with any money over the applicable tax threshold being eligible for taxation.

Your tax code will usually be made up of letters and numbers. The letters and numbers indicate different things. Numbers show the amount you can earn tax-free. This is called your personal allowance and is found by adding a zero to get the real number. For example, 1257 means you can earn £12,570 a year tax-free.

The letters relate to your situation and how it alters your personal allowance. There are many different letters. For a full guide check out the UK Government website.

What is a HMRC Tax Calculator?

An income tax calculator is a tool that will help you calculate taxes you are liable to pay using the tax rules of the UK. It often takes the form of an online or offline software tool. The calculator takes basic information like annual salary, tax codes, etc. to calculate the tax liability of an individual.

How Do HMRC Tax Calculators Work?

The amount of tax you pay is based on your total income for the tax year. This includes all paying jobs, interest on savings, and rental income from a second property that you own. Your personal allowance is fixed and will be shared between all of them. This makes working out tax liability for those with multiple revenue streams difficult.

A tax calculator takes the salary information as well as the tax code and then works out the amount of tax the individual is liable for. A good tax calculator will work out the best way to divide the tax code to minimize the amount of tax paid.

What are the Benefits of Using a HMRC Tax Calculator?

There are many benefits to using a tax calculator to find out your tax liability. In this section we will discuss a few in more detail.

1. Planning For Tax Liability

Using a tax calculator is a good way to plan ahead and see exactly how much tax you are liable for. This is especially important for self-employed workers or those with multiple revenue streams.

2. Fewer Errors

A good tax calculator takes all relevant tax factors into account when working out tax liability. It also ensures that the correct calculations are made. This can prevent errors and ensure the right amount of tax is paid.

3. Time Saving

Tax calculations are complex and working out tax liabilities can be time-consuming. This is especially true when working out figures by hand. Double-checking findings (which is always recommended) can increase efforts exponentially. A good tax calculator takes the effort out of tax calculations by automating the process.

4. Easy to Use

Most tax calculators are easy to use and user-friendly. Many will guide you through the calculation process by asking for information one step at a time.

Our Payroll is trusted by small and medium businesses

Papershift has been awarded the CyberChampion Award for its solution in roster, employee absence and leave planning and time tracking.

Automation for HMRC calculator & payroll accounting

The personnel costs required for payroll accounting are calculated automatically and can be exported in the DATEV/SBS-optimized format. This way, the data can be easily forwarded to your payroll office or your tax advisor, where it can be offset against taxes and social security contributions, etc.

Always there to help you with Payroll & your questions

- Michael

Product Manager

- Alex H

Customer Success Manager

- Chris

Sales Lead

- Dylan

Account Executive

14 days free of charge and without obligation test.