Jump to

The digital personnel file for SMEs – your guide for 2025 and beyond

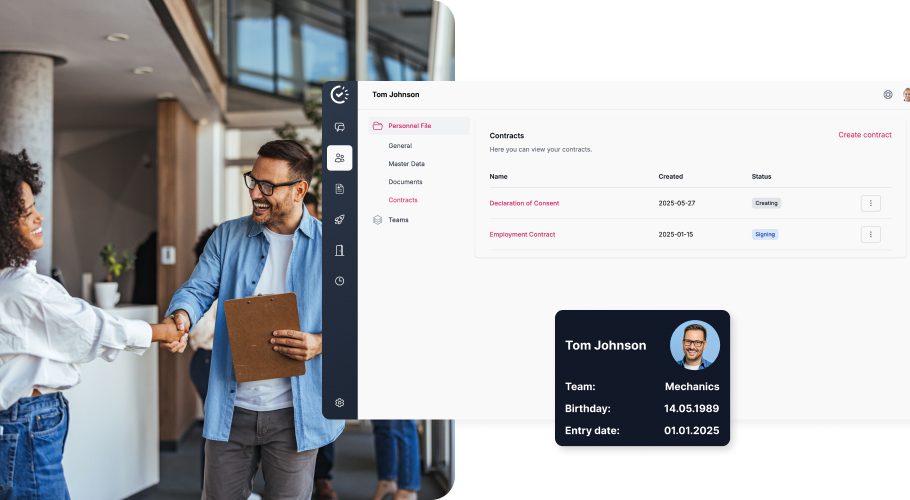

Digital personnel files offer significant advantages, especially for small and medium-sized enterprises (SMEs). They reduce administrative work and allow employees to focus on important core tasks.

The management of employee data and documents is a central component of human resources work. Traditionally, companies used physical personnel files in paper form for this purpose. However, this classic method is increasingly posing challenges, especially for small and medium-sized enterprises (SMEs): considerable space requirements for archive rooms, inefficient and time-consuming search processes, and severely limited and often cumbersome access to important information.

Digital personnel files offer a modern, efficient, and, above all, future-proof alternative. They enable the centralized, structured, and secure management of all employee-related documents and data in electronic form. For SMEs, the switch to digital personnel files is much more than just a technological trend. It is a strategic necessity, not only to optimize their own HR processes and remain competitive, but also to be perceived as an attractive employer.

Advantages of digital personnel files for SMEs

The decision to use digital personnel files brings a number of advantages that are particularly important for SME structures:

- Time savings: Access to the information and documents you need is significantly faster. There is no more tedious searching through file folders, which increases the efficiency of the HR department. For SMEs, whose HR departments are often lean and staffed by just a few people, this represents an enormous lever for increasing productivity.

- Space and resource savings: Physical file folders and separate archive rooms become redundant. This not only saves valuable office space, but also reduces ongoing costs for paper, printer supplies, and external storage.

- More efficient personnel management: Many HR processes can be optimized and partially automated through digital workflows. Examples include onboarding new employees, processing vacation requests, and documenting employee reviews.

- Improved data security and data protection (GDPR compliance): Modern systems for digital personnel files often offer greater protection than traditional filing cabinets. Differentiated access permissions, encryption technologies, and detailed logging functions ensure more effective data protection in accordance with the General Data Protection Regulation (GDPR).

- Location-independent access: Authorized persons can access digital files at any time and from anywhere, provided that the appropriate technical infrastructure is in place. This supports flexible working models such as working from home, which are also becoming increasingly important for SMEs in order to be considered attractive employers.

- Cost savings: In the long term, digitization leads to a reduction in administrative, material, and potential storage costs. In addition to direct savings on paper and postage (e.g., for sending pay slips), the working time gained is a particularly significant factor.

For SMEs, the return on investment (ROI) of a digital personnel file cannot be measured solely in terms of direct financial savings. At least as important is the freeing up of HR resources for strategic tasks. In smaller teams, where HR managers often cover a wide range of tasks as generalists, administrative activities such as manual file management take up a disproportionately high proportion of working time. The time saved through digitization can instead be used for value-adding activities such as personnel development, the development of recruiting strategies, or measures to retain employees.

What belongs in a digital personnel file – your checklist for SMEs

The personnel file, whether in paper or digital form, serves to collect all essential documents and information relating to a specific employee and the development of their employment relationship. The form of file management is not strictly prescribed; however, the completeness and accuracy of the information contained therein are crucial. For SMEs, structured and complete personnel files are essential in order to meet legal requirements and have a solid basis for personnel decisions.

The following checklist provides a practical overview of the typical and necessary contents of a digital personnel file, categorized for better clarity. It serves as a directly applicable tool for setting up or reviewing your digital personnel files and helps to ensure completeness while avoiding irrelevant data. This is particularly valuable for SMEs that may not have specialized HR departments that have such structures in place as standard.

Table 1: Checklist – Contents of digital personnel files for SMEs

| Category | Document type/information | Notes |

| Personal data/master data | Name, date of birth, address, contact details, nationality, bank details | Basic identification and contact details of the employee. Correct bank details are essential for salary payments. |

| Preliminary contract data | Application documents (cover letter, resume, references), personnel questionnaires, aptitude tests (if applicable), references | Documentation of the selection process and qualifications. Medical reports only if they are absolutely necessary and legally permissible for the activity. |

| Work and residence permit (for non-EU citizens), copy of disability card (if applicable and relevant) | Proof of authorization to take up employment or documentation of a special status | |

| Contract data | Employment contract and all contract amendments (e.g., promotion, transfer, adjustment of hours, salary adjustment) | The central document that regulates the rights and obligations in the employment relationship. Changes must be fully documented |

| Confidentiality agreements, supplementary agreements (e.g., regarding company cars, working from home) | Important supplementary regulations on the employment relationship | |

| Documents relating to the termination of employment (letter of termination, termination agreement, settlement agreement) | Documentation of the exit process | |

| Job references (interim and final references) | Important documents for the employee’s further professional career | |

| Development data | Proof of further education and training, certificates, training participation | Documentation of the employee’s qualification development |

| Performance appraisals, target agreements, minutes of employee appraisals | Basis for personnel development measures and performance management | |

| Warnings | Documentation of breaches of contract as a prerequisite for any subsequent steps under labor law | |

| General data | Correspondence between employee and employer (if relevant to the employment relationship) | Important correspondence relating to the employment relationship |

| Vacation requests and approvals, documentation of absences (e.g., parental leave, special leave) | Proof of vacation entitlements and vacation time taken, as well as other approved absences | |

| Certificates of incapacity for work (AU certificates) | Proof of absence due to illness (without diagnosis!) | |

| Information about approved secondary employment | Documentation on compliance with contractual obligations | |

| If applicable, notes about membership in the works council (if applicable) | Relevant information for aspects of works constitution law | |

| Job description | Definition of the scope of tasks and responsibilities | |

| Tax information | Tax identification number (tax ID) | Necessary for the correct payment of wage tax |

| Information on tax class, child allowances, religious affiliation (for church tax) | Required for correct payroll accounting | |

| Social security data | Social security number (copy of social security card, if applicable) | Clear identification in the social security system |

| Social security registrations and deregistrations (DEÜV notifications) | Proof of correct registration with the social insurance institutions | |

| Health insurance membership certificate | Proof of health insurance. Digital compulsory from 2027 | |

| Proof of compulsory/exemption from social security contributions | Important e.g. for managing directors, contributing family members. Digital mandatory from 2027 | |

| Remuneration data | Salary or wage statements | Detailed breakdown of the remuneration, obligation to keep records |

| Proof of salary development, bonus agreements, other allowances | Documentation of financial development and special benefits | |

| Income tax documents (e.g., income tax statement at the end of the year) | Important documents for tax purposes | |

| Other (if relevant) | Copy of driver’s license (if required for the job, e.g., field service) | Proof of driving license |

| Health certificate/instruction in accordance with the Infection Protection Act (for employment in the food sector) | Proof required by law in certain industries | |

| Documents relating to company pension schemes | Documentation of claims and agreements |

Special features for SMEs: Are there specific documents that you should keep an eye on?

There are hardly any document types that occur exclusively in SME personnel files and not in larger companies. The basic principles of labor law and social security law are largely identical. The difference for small and medium-sized companies lies less in the type of documents and more in the handling, prioritization and context in which the personnel file is kept.

For SMEs, it is crucial to focus on the documents that are absolutely critical for legal compliance and minimizing liability risks. These include, in particular, flawless employment contracts, fully documented contract amendments, evidence of the correct accounting of wages and salaries and social security contributions and careful documentation when employment relationships are terminated. Equally important is the documentation of warnings or other disciplinary measures, as these are often a prerequisite for subsequent steps under employment law. Evidence of legally required training (e.g. in the area of occupational safety or data protection), even if it is not always a classic part of the personnel file in the strictest sense, is often closely related and should be carefully managed.

In addition, the digital personnel file can play an important role in the professionalization and standardization of HR processes in SMEs. In smaller company structures, processes are sometimes less formalized and more dependent on individuals than in large companies with established HR departments. The need to define a clear structure and content when introducing a digital personnel file can help with this. This process forces existing HR processes to be critically scrutinized, standardized and documented. For example, standardized checklists can be developed for the onboarding of new employees, the completion of which is then documented in the digital file in a traceable manner. This not only leads to greater transparency and traceability, but also reduces dependency on individuals and thus strengthens the company’s organizational resilience. The digital personnel file is thus transformed from a mere repository into an active process design tool.

The digital personnel file as a strategic advantage for your SME

The digital personnel file is evolving from an optional modernization to an increasing necessity for small and medium-sized companies. The benefits in terms of increased efficiency, cost savings, improved data security and the fulfillment of compliance requirements are evident.

The digital personnel file is far more than just an electronic archive for employee documents. It is a central component and often the first important step on the way to comprehensively digitized and data-supported HR work. In a modern HR tech landscape, the digital personnel file can serve as a reliable database for a variety of other applications and analyses. Links with systems for talent management, personnel development, applicant management or HR analytics tools are conceivable.

The structured recording and central availability of employee data in the digital personnel file enables SMEs to gain valuable insights – in strict compliance with data protection and purpose limitation. For example, fluctuation rates can be analyzed more precisely, training needs can be identified at an early stage and demographic developments in the workforce can be better understood. Such data-based insights make it possible to proactively manage personnel risks, target HR measures more effectively and ultimately make well-founded personnel decisions. The digital personnel file is thus evolving from a purely administrative instrument into a strategic tool that professionalizes HR work and can make a measurable contribution to the company’s success.

Digitalization in HR is a continuous process. The introduction of the digital personnel file can be an ideal starting point for many SMEs to take on the challenges of digital transformation and actively exploit the many opportunities for future-proof, efficient and employee-oriented HR work.

Summary

The use of digital personnel files brings many advantages for small and medium-sized companies. These include a considerable saving in the effort required to maintain documents. However, in order to get the most out of the digital personnel file, SMEs need to know which data belongs in it and which must not be included under any circumstances. Our checklist will help.